Sell put option calculator

The Covered Put Calculator can be used to chart theoretical profit and loss PL for covered put positions. If youre a put buyer use the Long Put tab and if youre a put seller use the.

How And Why Interest Rates Affect Options

The price of an option is a function of many variables such as time to maturity underlying volatility spot price of underlying asset strike price and interest rate it is critical for the option.

. Access Our Full Suite of Innovative Award-Winning Trading Platforms Built for Traders. Buyers of put options expect the price of the underlying to depreciate. Copies of this document may be obtained from your broker from any.

For example if ABC shares trade for 35 you could execute the put option that lets you sell. Profit Stock Price at Expiration Current Stock Price Premium. Prior to buying or selling an option a person must receive a copy of Characteristics and Risks of Standardized Options.

MIS gives you the auto square-off facility for open positions before market closes. Else If Stock Price at expiration Strike Price Then. Smartly designed order window and order.

Get the most from your trading by just paying a small margin. Download The Option Profit Calculator. Mutual Funds Retirement Investing Solutions.

Ad Choose From Over 60 Funds With 4 5 Star Ratings From Morningstar. Discover the Power of thinkorswim Today. Learn About Our Approach.

To create a covered put strategy add a short stock and a short put position to the. Step one is to download the file using the button below. As long as ABC corp shares trade below 40 your put option would be considered in-the-money.

See how this trading course helps small investors earns Extra Income. Ad Heres how ordinary people are earning 5000 - 20000 each month in their spare time. The Option Calculator can be used to display the effects of changes in the inputs to the option pricing model.

The long put calculator will show you whether or not your options are at the money in the money or out. The strike price definition is the same here but for a different purpose. So to calculate the Profit enter the following formula into Cell C12.

Put option - An offer to sell shares at a pre-determined price. Sellers of a put option have an. When the underlying asset price goes below the strike price the owner.

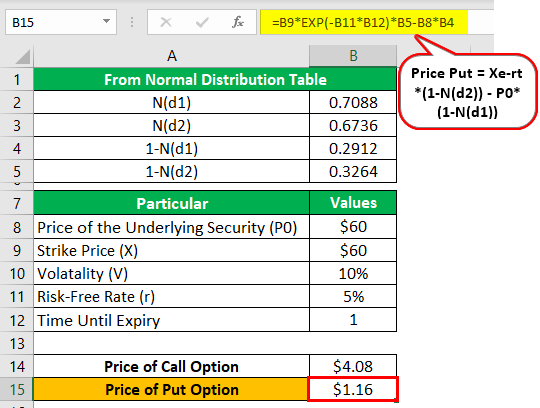

If you have shares of a stock put options shield you from any losses below the strike price. Put Option Calculator is used to calculating the total profit or loss for your put options. The buyer of a Put option has a RIGHT to SELL the underlying at a pre-determined price.

Enter what-if scenarios or. The inputs that can be adjusted are. Strike price of a put option.

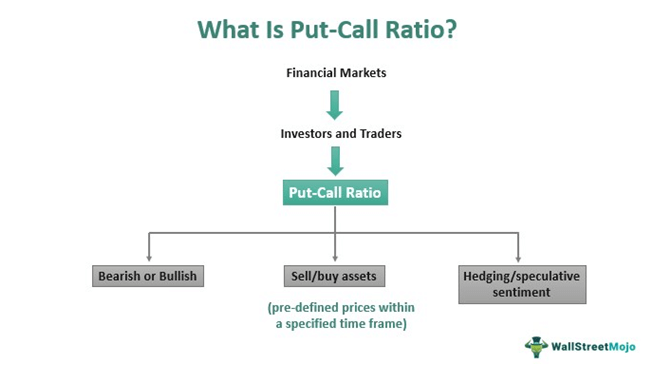

Premium - The current market price. Ad From Implied Volatility to Put-Call Ratios Get the Data You Need. Ad From Implied Volatility to Put-Call Ratios Get the Data You Need.

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

Options Basics How To Pick The Right Strike Price

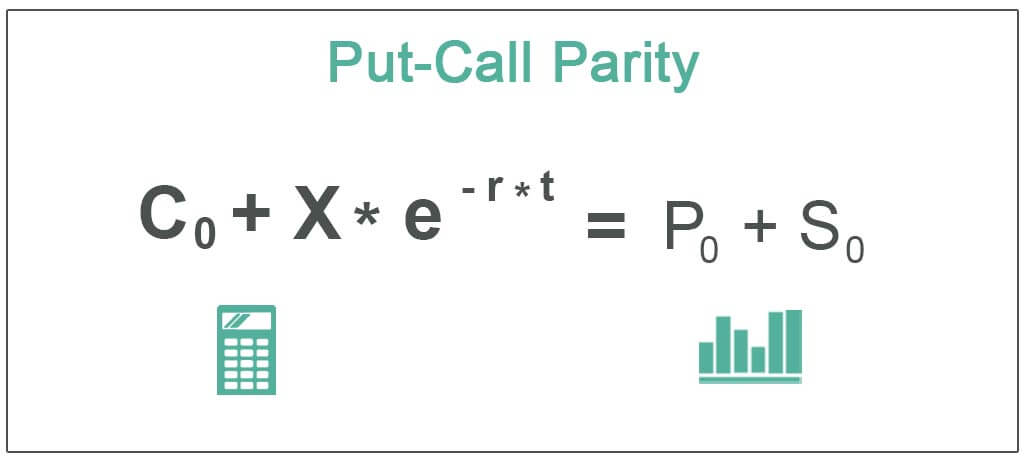

Put Call Parity Meaning Examples How Does It Work

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

What Is Call Option And Put Option A Beginner S Guide

/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

Options Basics How To Pick The Right Strike Price

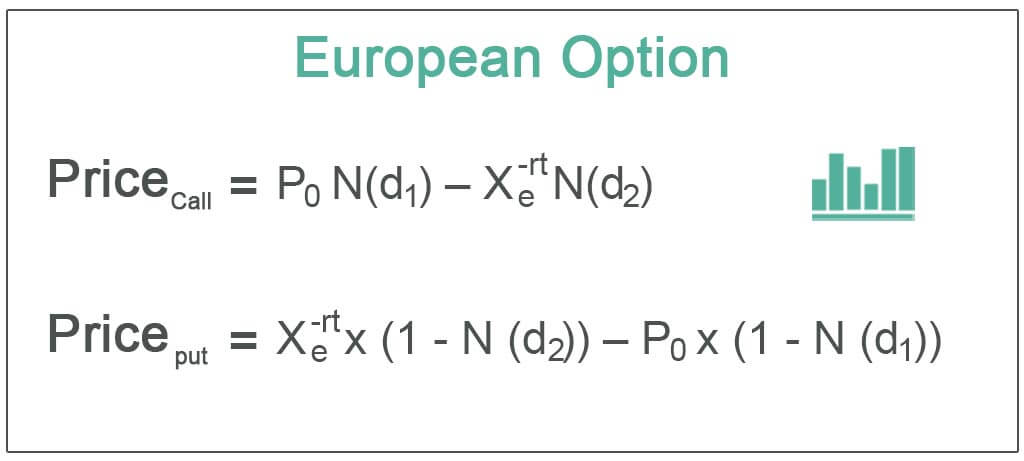

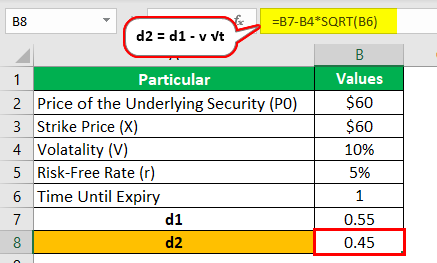

European Option Definition Examples Pricing Formula With Calculations

Put Call Ratio Meaning Example Indicator Trading Strategy

European Option Definition Examples Pricing Formula With Calculations

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

European Option Definition Examples Pricing Formula With Calculations

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-02-ba51015e895b4ba7abbd7632e1908360.jpg)

Option Pricing Models Formula Calculation

Understanding The Binomial Option Pricing Model

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

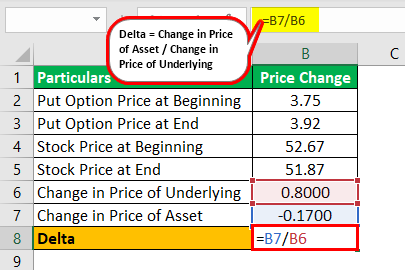

Delta Formula Definition Example Step By Step Guide To Calculate Delta

Call Option Calculator Put Option

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-04-3d62440d22b8498684ee7f7773b52c07.jpg)

Options Basics How To Pick The Right Strike Price

Options Buying Vs Selling Which Strategy To Use Trade Brains